I’ll take you step-by-step through the process of how to open an Ally bank account in this lesson. Ally Bank provides a more accessible and flexible banking experience and is simple to set up. This option is for you if you are working on loans or benefits like the SSA that need the bank to match the details.

STEP 0: CLICK HERE TO CHOOSE NON VBV CC

The features and advantages of opening an Ally Bank bank account are of great importance and include:

- Options for online banking

Annual percentage yield (APY) that is competitive

No monthly charges

24-hour client service

Service for Overdraft Transfers

Your financial objectives and the purpose for opening an account will determine the sort of account you can select, which is another crucial element. They are:

- Favorite Spending Account

Money market accounts, savings accounts, and certificates of deposit

Let’s begin by opening the spending account for the purposes of this lesson, which includes using it for loan transfers and other advantages.

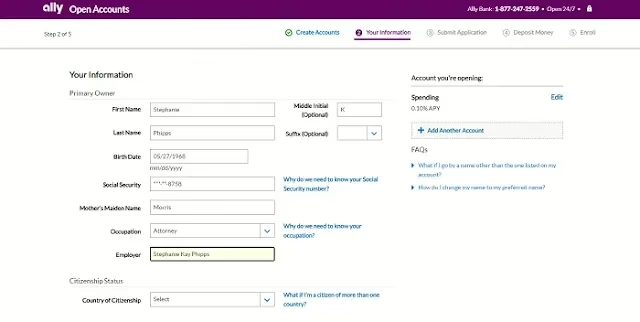

In order to create an account, you must:

Customer Complete name: RDP, Sock5, or VPN

The Social Security number

Date of birth, present address, and, if you have been at your current residence for less than five years, your former address

Employment

The drop name’s email Call number dropped (not Google Voice)

Maiden name of the mother

Details of the transfer for your first deposit

How To Open an Ally Bank Account GUIDE

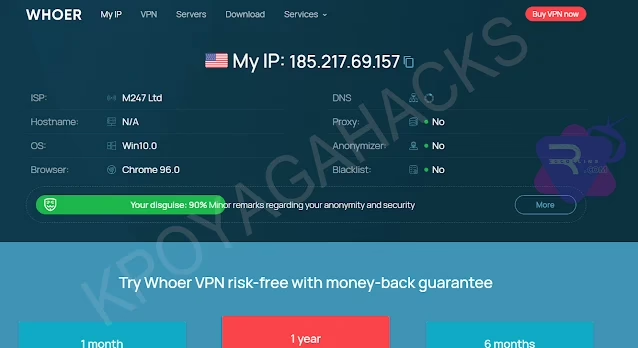

1. Connect the IP to the drop address and make sure everything is clean after you have met all the conditions.

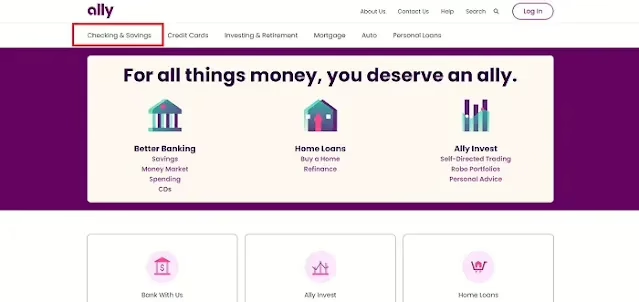

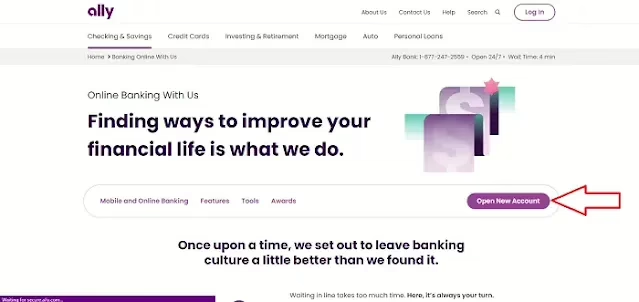

2. Next, click “Checking & Savings” at https://www.ally.com/.

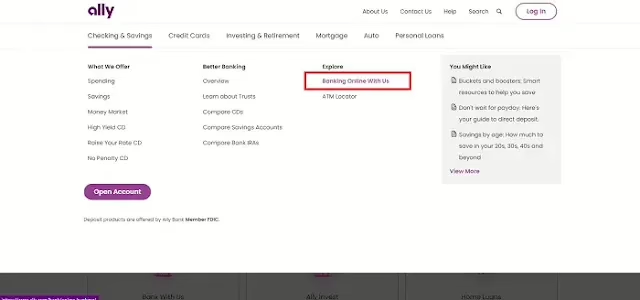

After selecting “Checking & Savings,” select “Banking Online With Us.”

4. Then click on “Open New Account.”

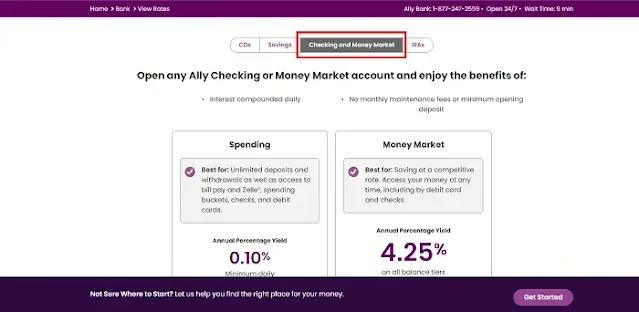

5. Select the choice for checking and money markets.

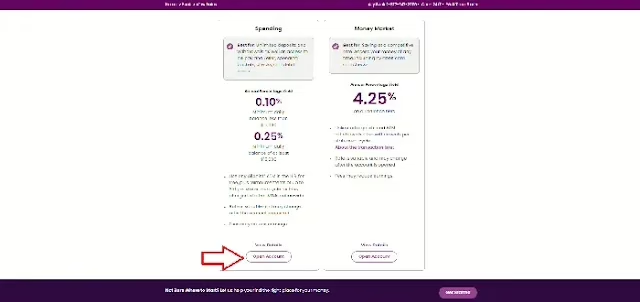

6. Under spending, click on “Open account.”

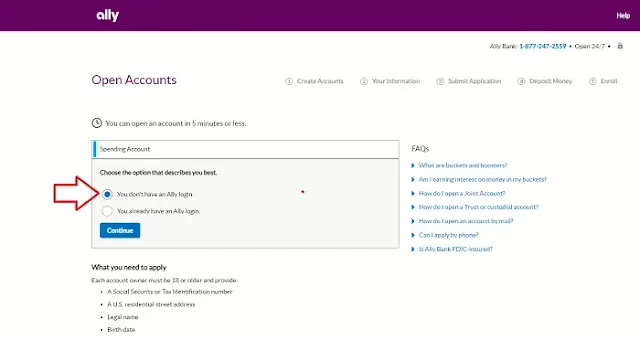

7. Click “Continue” after selecting “You don’t have an ally login”

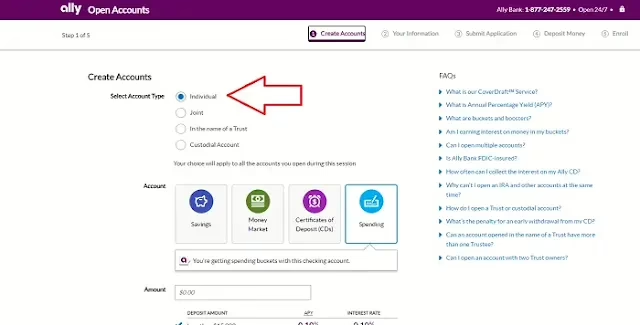

8. Verify that the account type is personal.

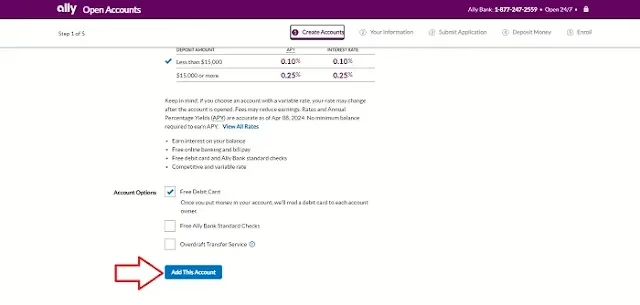

9. After everything appears as it does, click Add this account.

HOW TO AVOID YOUR ORDERS FROM BEING DECLINED AS A CARDER.

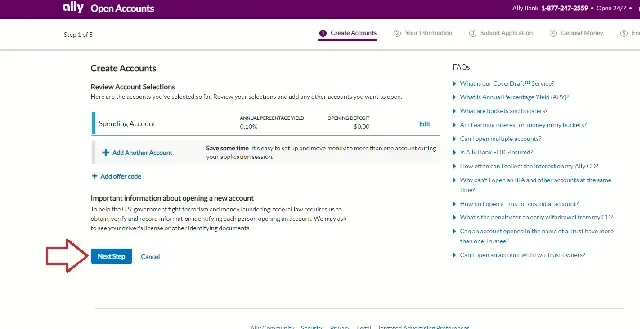

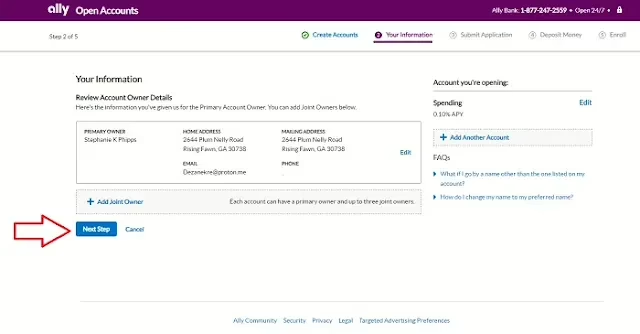

10. Click on Next Step

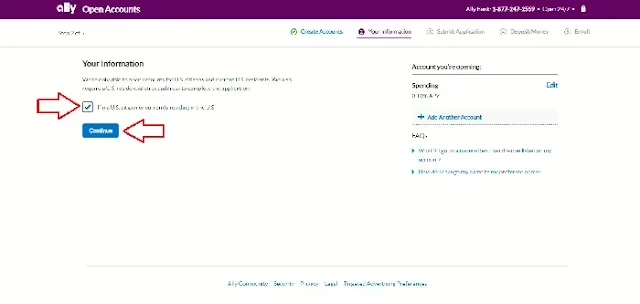

11. Select “Residence” and click “Continue.”

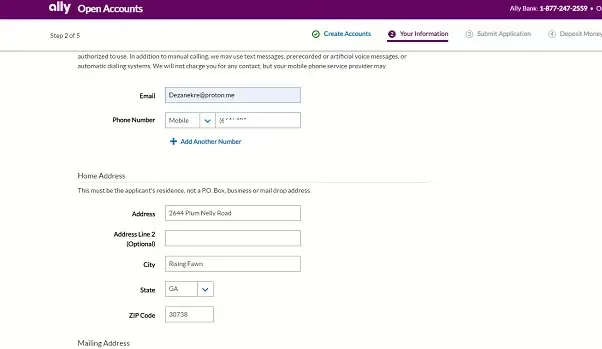

12. Fill in the drop-down personal details here

13. The client’s name should appear on the email. Enter the current address and a real phone number.

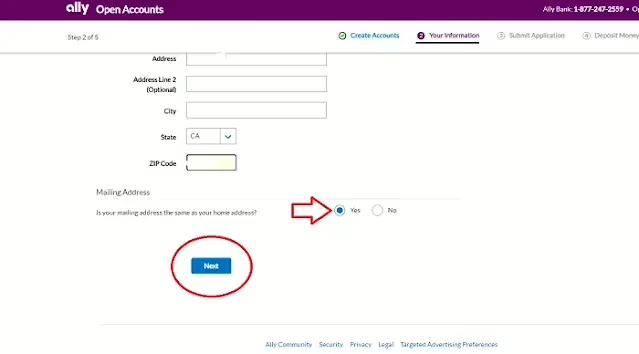

14. Click No and provide your address if you would like to mail the card to a different drop.

15. Click on Next Step

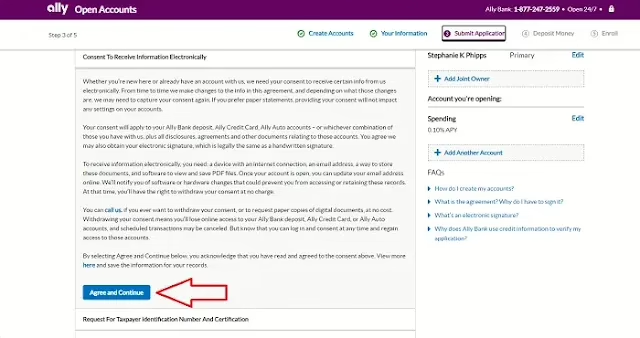

16. Press “Agree” to proceed.

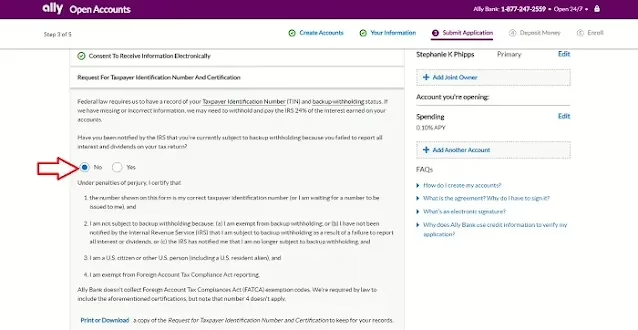

17. Make sure you select “no.”

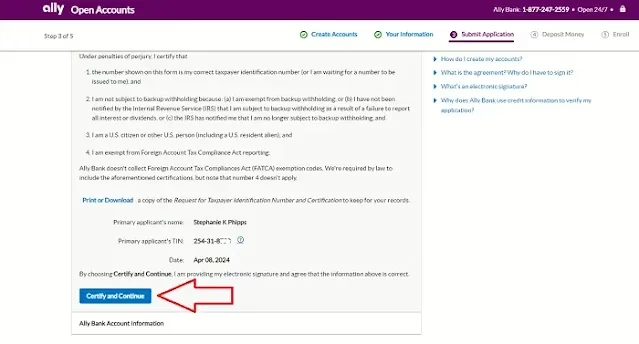

18. Select Certify and Proceed.

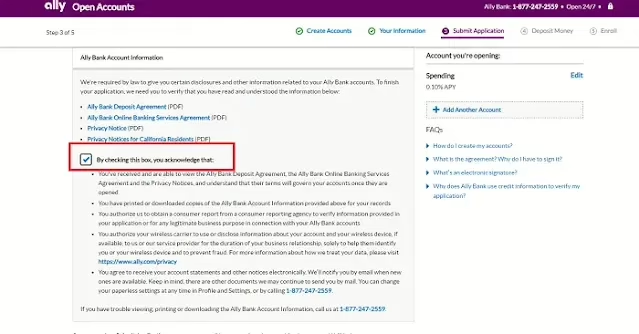

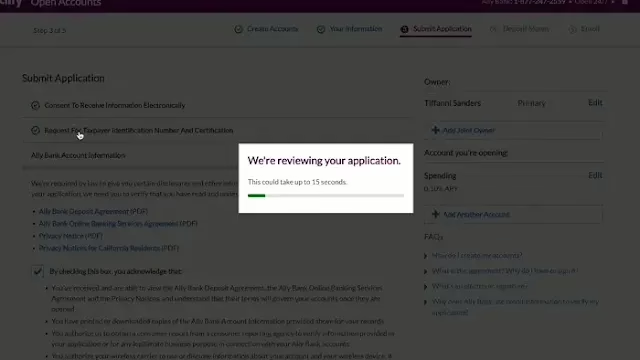

19. Check the acknowledgement box, then click “Submit.”

20. Await their review of your information.

21. Next, click Send Link. Copy the link to your browser when you get it.

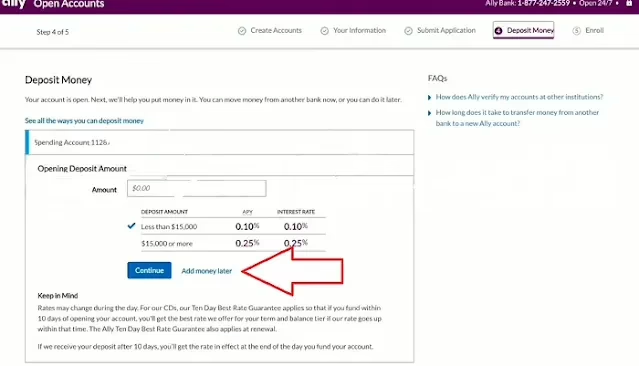

22. After reviewing, you should see this, which directs you to the next page for the initial deposit. If you don’t have the funds for the initial deposit, click Add Money later.

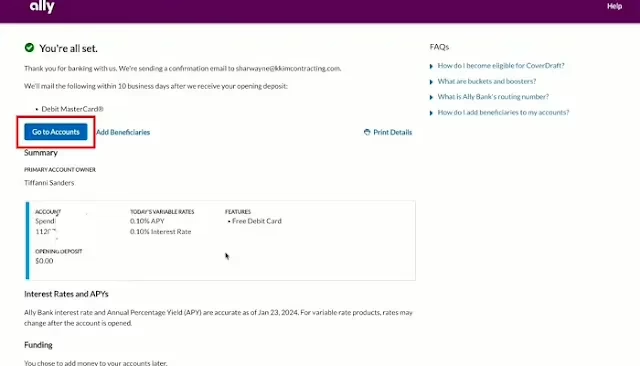

23. Now create your online access, which is the username, passed, and security question

24. Then click on Create and go to the account

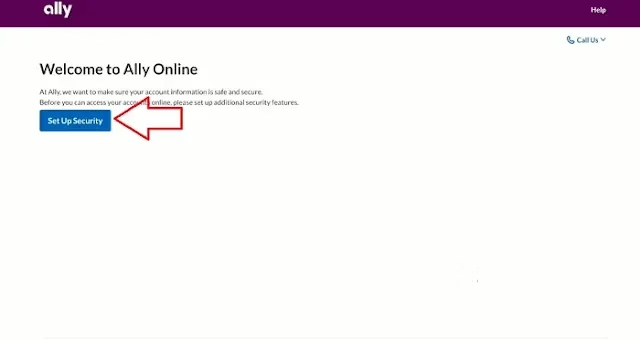

25. Click on Setup security

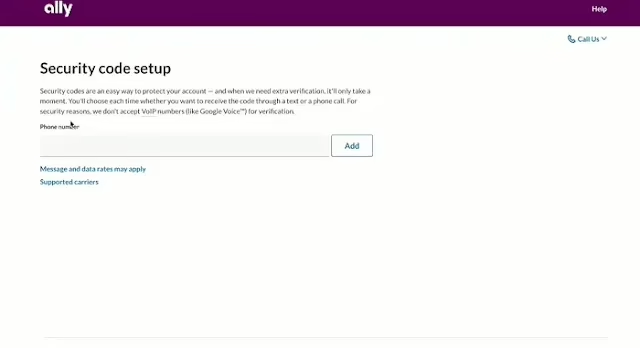

27. Add a Real phone number, not a void number

28. Choose Yes, this is a trusted computer or device, and continue

29. Click on Go to My account

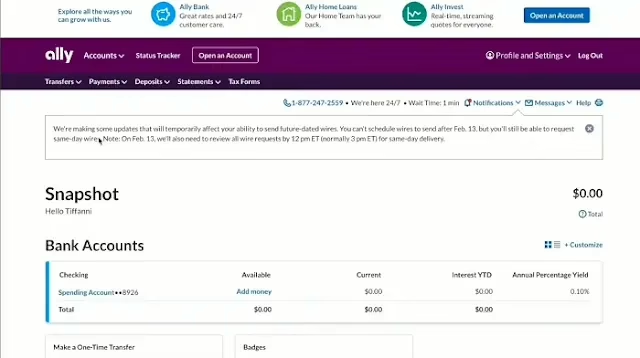

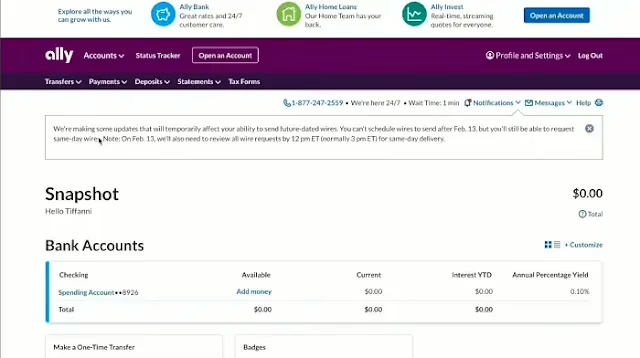

30. Your Ally Bank Account